The Museum Nobody Can Rob

You've been avoiding understanding Bitcoin. Smart move. Most explanations are either too technical to follow or too evangelical to trust.

Bitcoin is weird, but it's not complicated. And the weird parts are actually the interesting parts.

Start With the Problem

You have ten dollars. You hand it to me. Now I have it, you don't. Simple.

But what if those ten dollars is just a number in a computer? You could copy it. Email it to ten people. Spend it twice. The same digital file can exist in multiple places simultaneously.

So how do you create digital money that can't be copied?

Bitcoin's answer: build a museum where everyone can see everything, and changing history requires the impossible.

The Public Museum

Imagine a museum with glass walls. Every exhibit is visible from outside. Anyone walking past can see exactly what's displayed and in what order.

But these aren't physical objects you could steal. The exhibits are records, projections of transaction history. "Sarah transferred 0.5 Bitcoin to Mike at 2:47pm on March 15th." That's an exhibit. It stays on display forever.

The glass walls don't protect the exhibits. They ensure everyone can witness them. You can't steal a historical record any more than you could steal the fact that something happened. What you could try to do is alter that record, add false entries, or erase old ones. That's what the security system prevents.

Thousands of identical museums exist worldwide, each maintaining the exact same collection in the exact same order. When a new exhibit gets added to one museum, all the others update simultaneously. No corporation runs these museums. No government owns them. Just software running on computers, maintaining identical collections.

Before your transaction becomes an exhibit, every museum checks their complete catalog. Do you actually have the Bitcoin you're trying to transfer? Did you already transfer it to someone else five minutes ago? If everything checks out, your transaction becomes a permanent record in every museum simultaneously.

That's the blockchain. A synchronized catalog of transaction records nobody can alter because everyone's watching.

The Vault Competition

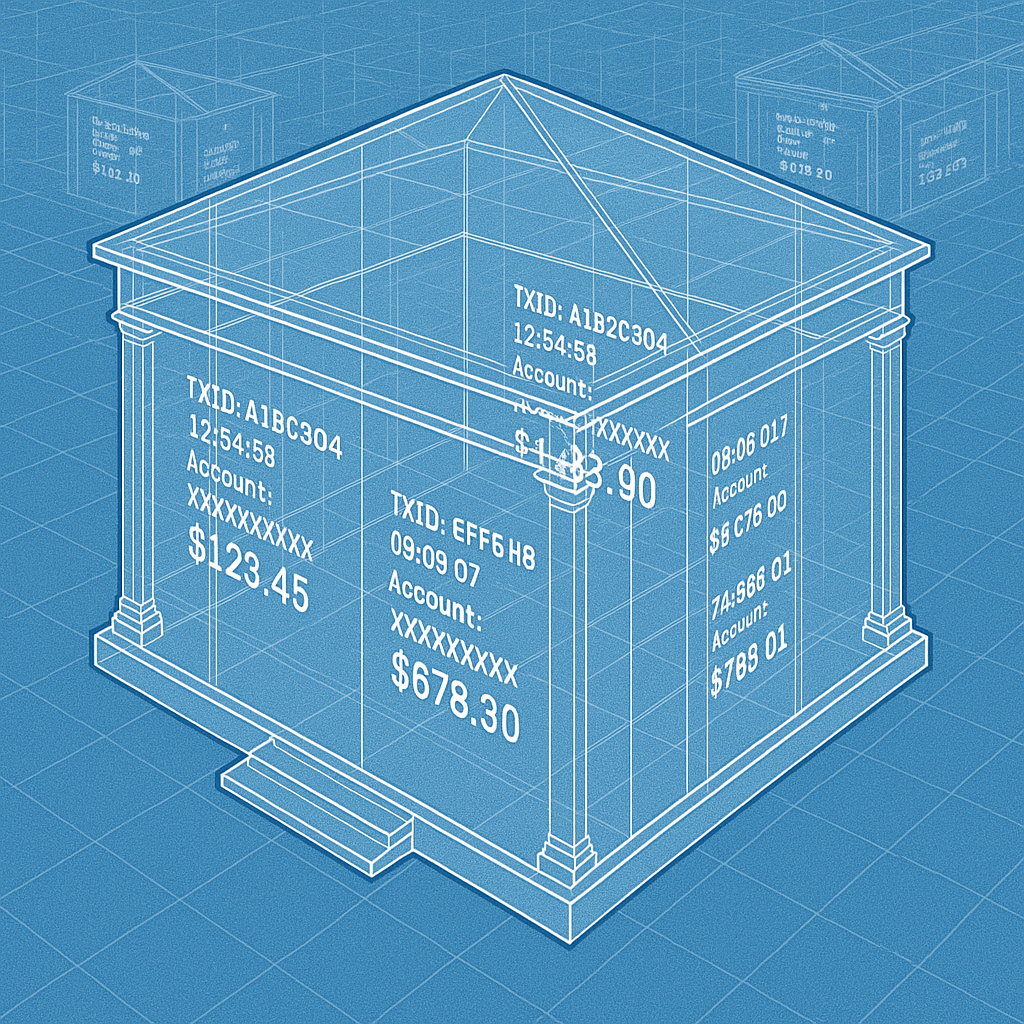

Every ten minutes, someone gets to add a new room of exhibits to this museum. But first, they must crack the vault.

The vault has a combination lock that changes every ten minutes. Thousands of people worldwide race to guess the new combination. Not clever deduction. Just computational brute force. Trying billions of random numbers until someone succeeds.

Whoever cracks the lock first gets two privileges:

Add the next room of exhibits

The winner gathers recent transactions waiting to be cataloged, verifies they're legitimate (checking that the senders actually possess what they claim to be transferring), and adds them as a new wing to every museum worldwide.

Place one special exhibit in the room

The winner adds one transaction that says: "Award 3.125 Bitcoin to me." This is how new Bitcoin enters circulation. Not printed by a central bank. Not minted. Simply awarded to whoever solved the vault puzzle.

If the global network of museums verifies everything is legitimate (the combination was correct, the transactions are valid, nothing fraudulent occurred), the new room gets permanently added. Every museum updates its layout identically.

Then the vault resets. New combination. New competition. Another room added ten minutes later.

This process is called mining. The name suggests digging for treasure, which captures it well. You expend resources (electricity, computing power) to extract something valuable (Bitcoin).

Your Museum Pass

Here's where the metaphor gets precise.

A Bitcoin wallet isn't a container. It's a museum pass with two components:

Your visitor number (like a membership ID). This is public. Share it when you want someone to transfer Bitcoin to you. It appears on the museum exhibits whenever transactions involve you.

Your authentication code (like a password that can never be reset). This proves you have authority to authorize new exhibits involving your visitor number. It's a long string of random characters. Whoever controls this code controls the Bitcoin associated with that visitor number.

You can create a wallet using an app, a hardware device, or by writing the codes on paper. The wallet doesn't store Bitcoin. The Bitcoin exists only as exhibits in the museum catalog, visible to everyone.

Your wallet stores the cryptographic proof that you're allowed to authorize transactions. When you "send" Bitcoin, you're signing a request saying "I authorize moving this amount from my visitor number to this other visitor number." The museums verify your signature matches your number, check that you have sufficient holdings in the catalog, and if everything confirms, your transaction becomes the next exhibit.

Lose your authentication code? You've lost access forever. Nobody can reset it, recover it, or prove you're the rightful owner. The Bitcoin remains cataloged in the museums, forever associated with a visitor number nobody can access.

The exhibits show you own Bitcoin. But without your code, you can't authorize any changes. Your wealth is visible but permanently frozen.

Why the Museum Got Crowded

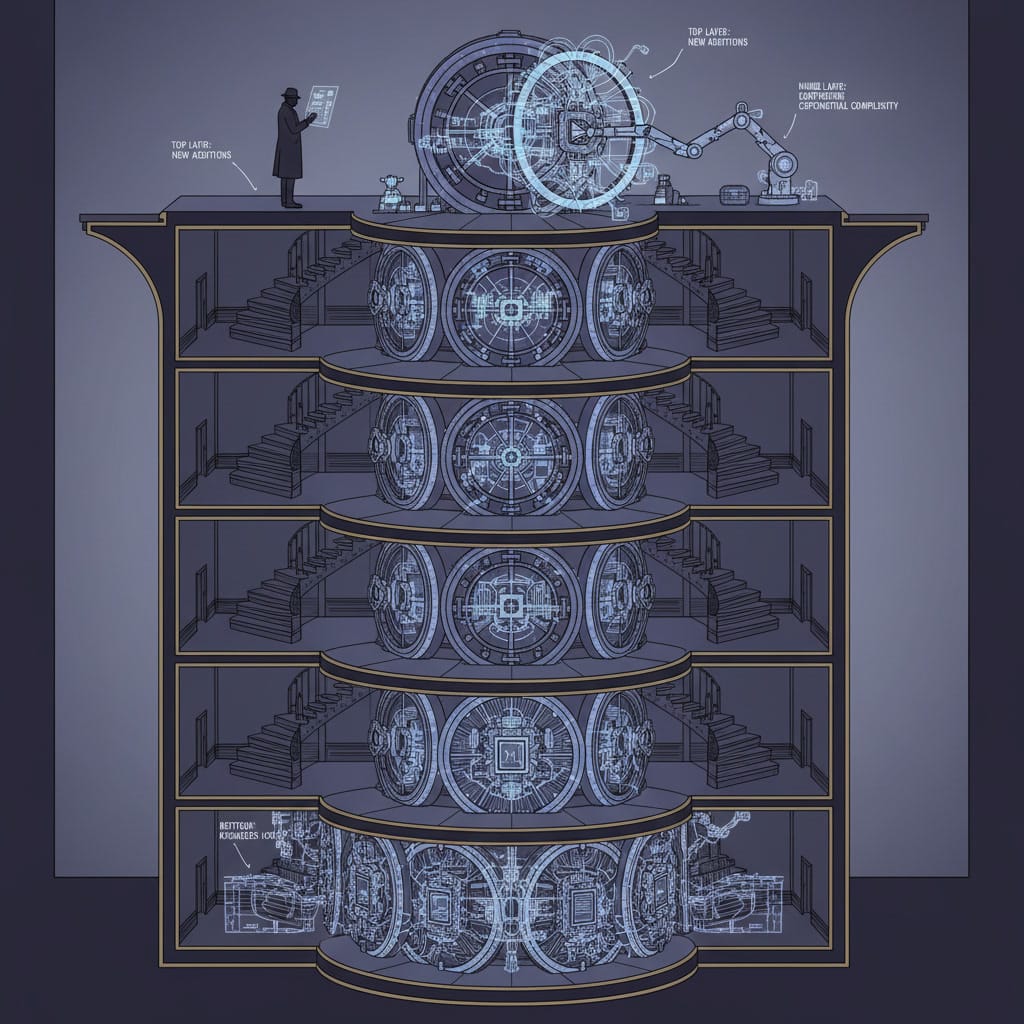

Early on, you could crack the vault using a regular laptop. The combinations were simpler because fewer people competed. The system automatically adjusts difficulty to maintain that ten-minute rhythm for adding rooms.

As Bitcoin gained value, more people started competing. More competition meant harder combinations. Home computers became obsolete. Specialized combination-cracking machines took over. Then warehouses full of these machines. Operations using enough electricity to power small cities.

The hobby phase ended. The industrial phase began. The museum kept growing, but the competition to add new rooms intensified dramatically.

Now the Interesting Part

You understand how it works. Here's why it matters.

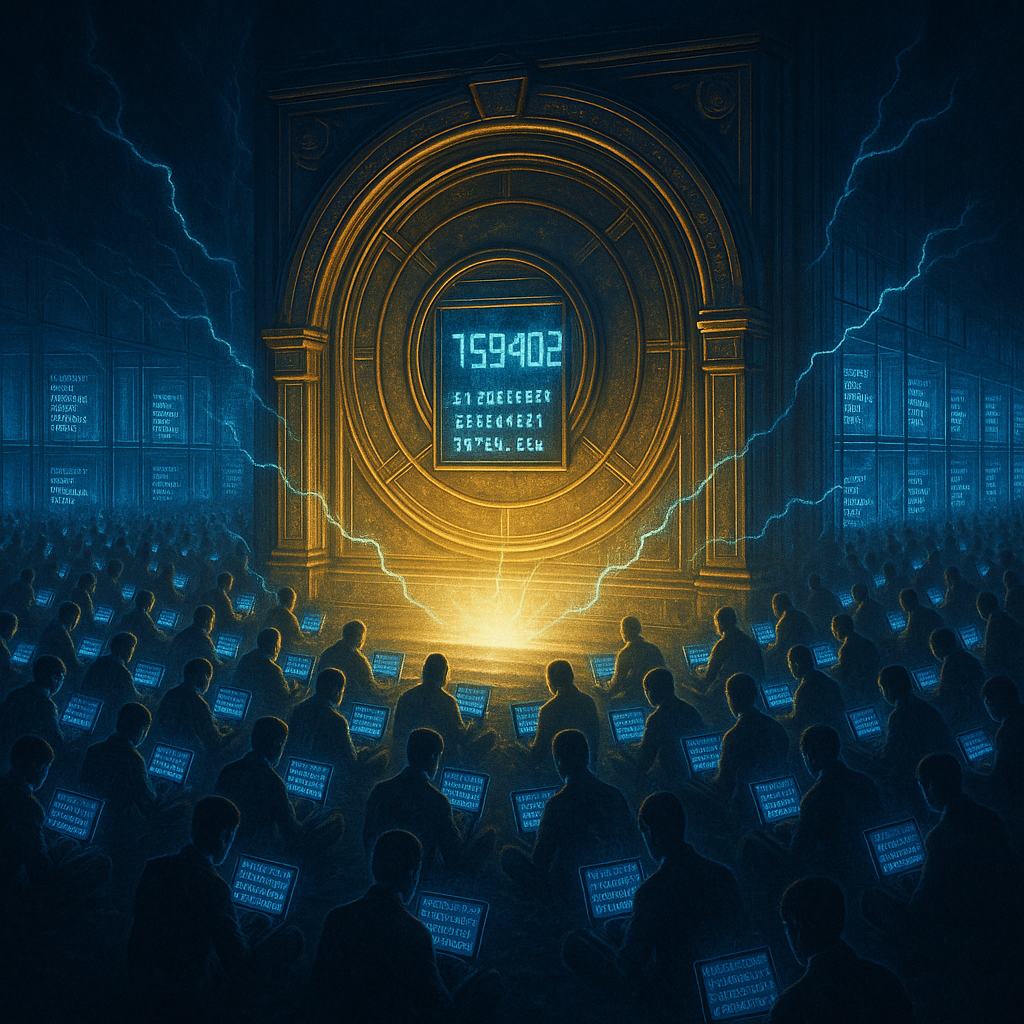

The Museum's True Defense

The museum appears vulnerable. Glass walls. Everything visible. No guards. No weapons. No gates.

Yet it's the most secure financial record ever created. Here's why.

The threat isn't someone smashing glass to steal exhibits. The exhibits are records, not physical objects. The threat is someone rewriting history, altering the catalog, inserting false transactions, or erasing legitimate ones.

Every room of records sits behind its combination lock, and those locks stack. To alter a record from yesterday, you'd need to:

- Crack yesterday's combination again

- Crack every combination from yesterday until now

- Keep cracking them faster than everyone else is solving today's combination

- Maintain that lead indefinitely

The deeper into the museum's past you want to reach, the more combinations separate you from your target. And while you're busy re-cracking old locks, thousands of competitors add new rooms with new locks.

The oldest records sit behind fifteen years of accumulated combinations. Billions of guesses. Exabytes of computation. To change them, you'd need to redo all that work faster than the entire current network operates.

This isn't a theoretical impossibility. It's an economic impossibility. The cost of the attack would exceed any conceivable benefit.

The museum's defense isn't guards you can bribe or walls you can breach. It's mathematics and expended energy. The locks aren't physical. They're computational history, accumulated difficulty, sunk work.

You can't fake it. You can't shortcut it. You have to actually burn the electricity, try the combinations, do the work.

Trust Still Exists, Just Distributed

Bitcoin supporters pitch it as freedom from institutions. No banks. No governments. Pure decentralization.

Except you're still trusting something.

You're trusting that the majority of vault-crackers stay honest because cheating costs too much. You're trusting that the museum software works as designed. You're trusting that enough people inspected the code. You're trusting economic incentives to prevent collusion.

Bitcoin doesn't eliminate trust. It converts trust from institutions to mathematics and game theory.

The innovation isn't removing intermediaries. It's making betrayal expensive and visible. Every transaction becomes a public exhibit. Every attempt to cheat requires overpowering the entire global network.

The system doesn't run on trustlessness. It runs on aligned incentives.

The Electricity Question

Critics point to Bitcoin's massive energy consumption. They're not wrong about the scale. The network uses as much electricity as some countries.

But consider what that electricity purchases: an impossible heist.

Remember how the museum works? Every past exhibit sits behind all those previous combination locks. The electricity isn't wasted. It's the accumulated difficulty of all those locks. Each kilowatt-hour spent mining makes the museum harder to alter retroactively.

Compare this to how we currently secure money:

Armed guards standing watch. Armored trucks burning diesel. Bank vaults made of concrete and steel. Fraud detection systems running 24/7. Global surveillance networks. Physical currency that gets printed, distributed, shredded, replaced. Entire buildings devoted to financial security.

We just don't measure it all in one place and call it excessive.

Bitcoin makes the cost visible and quantifiable. All that computational work converts directly into security. The museum's early rooms are now protected by years of accumulated puzzle-solving.

We've always spent resources to secure money. Bitcoin just makes you watch instead of hiding it across a thousand line items and institutions.

Ownership Gets Strange

our Bitcoin wallet holds two things: a public visitor number and a private authentication code. But you don't actually possess Bitcoin. You possess authority to commission new exhibits involving your visitor number.

What does ownership mean when the thing can't be held, seized, or physically destroyed?

Traditional ownership comes with safeguards. Courts can reverse fraudulent transfers. Banks can freeze suspicious accounts. Police can recover stolen property.

The museum offers none of this. The system can't distinguish between you and someone pretending to be you. Whoever has the authentication code can commission exhibits. Once an exhibit opens, it's permanent.

This is either radically egalitarian or deeply dystopian, depending on whether you're holding the codes or watching someone else hold them.

The museum treats "whoever controls the code" and "the rightful owner" as identical concepts. There's no appeals process. No mercy. No reset button. The catalog is permanent and indifferent.

Nobody's Curator and It Still Works

The museum functions despite having no curator, no director, no board of trustees.

Thousands of vault-crackers worldwide follow the same protocol without enforcement. No police mandate the rules. No courts interpret them. No government requires participation. Yet the museums stay synchronized, validate exhibits identically, maintain the same catalog.

They do this voluntarily. Sometimes at a loss. Sometimes in countries actively hostile to cryptocurrency.

This is game theory in action. Game theory studies strategic decisions where your best choice depends on what others choose. In Bitcoin, the incentives are structured so that selfish behavior accidentally produces honest cooperation.

Here's how it works:

If you play honestly: Crack the vault legitimately, add valid exhibits, collect your Bitcoin reward. The network accepts your work. Your reward has value because everyone recognizes it.

If you cheat: Try to add fraudulent exhibits, double-spend Bitcoin, or manipulate the catalog. Other museums reject your work. Your mining reward becomes worthless because nobody accepts your version. All that electricity you spent? Wasted money.

The system doesn't require good people. It just requires that honest behavior pays better than dishonest behavior. Individual self-interest produces collective benefit without anyone intending it.

When someone cracks the vault and proposes new exhibits, every museum independently verifies the work. They check that the combination was solved correctly, that transactions are legitimate, that nothing fraudulent occurred.

Nobody forces them to accept it. They could reject it or maintain an alternative catalog. But doing so would put them out of sync with the network. Their version would diverge. Their efforts would become worthless on the minority chain.

Economic incentive drives honest behavior. Your mining reward only has value if the rest of the network accepts your exhibits.

Here's the uncomfortable truth: the museum system can't technically stop a coordinated attack. If 51% of vault-cracking power conspires, they could reorganize rooms, invalidate exhibits, censor transactions.

But game theory makes this attack irrational. Consider what it would cost:

You'd need to control majority mining power. That means owning or renting more computing equipment than everyone else combined. We're talking hundreds of millions of dollars in hardware and electricity.

Then what? You successfully attack the network. You double-spend some Bitcoin. You rewrite some exhibits.

And immediately:

- Trust in the museum collapses

- Bitcoin's price crashes

- The coins you just "stole" become worthless

- Your massive investment in mining equipment now mines worthless tokens

- You've spent a fortune to destroy the thing you tried to steal from

The defense isn't technical impossibility. It's economic absurdity. You'd spend millions to vandalize a collection you need to remain valuable. It's like buying a restaurant so you can burn it down.

Bitcoin doesn't prevent attacks through cryptography alone. It makes attacks cost more than any conceivable benefit. The game theory dictates that even if you could attack the museum, you wouldn't want to.

We're trusting that cooperation pays better than betrayal. That's still trust, just calculated differently.

Why This Shouldn't Work But Does

Bitcoin violates conventional explanations about why people value money.

The usual stories go like this: gold is valuable because it's useful and scarce. Dollars are valuable because governments declare them legal tender. These explanations confuse justification with causation.

Things aren't valuable because they're useful or scarce. People value them, and then we construct stories about utility and scarcity to explain our choices. Gold was a monetary metal for millennia before its industrial applications existed. Dollars hold value because people accept them, not because a law says they must.

Value is subjective. It emerges from human preference and social coordination, not from inherent properties.

Bitcoin makes this obvious. The museum catalog is valuable because people agree it's valuable. There's no pretense of objective worth, no story about intrinsic utility.

The Circular Logic That Actually Works

Bitcoin makes this obvious. The museum catalog is valuable because people agree it's valuable. There's no pretense of objective worth, no story about intrinsic utility.

This sounds circular. And it is. But most coordination works this way.

Language has value because others speak it. Roads have value because others drive on them. Standards have power because others follow them.

Bitcoin survives on game theory and stubbornness. The game theory makes cooperation more profitable than betrayal, even for purely selfish actors. The stubbornness ensures no single entity controls the museum. Both forces are surprisingly durable.

What Fifteen Years Proves

Fifteen years in, it still functions. That doesn't prove it's the future of money. It proves something stranger: you can build systems too distributed to shut down, too transparent to manipulate quietly, too expensive to attack profitably.

We created a museum from computational work and collective agreement. A financial record that exists everywhere and nowhere. Exhibits added by whoever solves puzzles fastest. Security derived from accumulated mathematics rather than armed guards.

The Real Strangeness

The weird part isn't that it's digital. We've had digital money for decades. Credit cards are database updates. Bank balances are numbers on screens.

Bitcoin asks different questions: What if the catalog belonged to everyone and no one? What if security came from making alterations expensive and visible? What if financial records could exist without someone in charge?

These aren't hypothetical questions. Bitcoin is the experiment running in real time.

It's inefficient by conventional measures. It uses significant energy. It's philosophically strange. And somehow it functions.

The Actual Lesson

Maybe the lesson isn't about cryptocurrency. Maybe it's about what becomes possible when you make trust costs explicit, rules transparent, and incentives aligned.

Maybe the museum nobody asked for reveals something we forgot: collections don't need curators if altering them costs more than maintaining them.

The combinations look excessive. The energy seems wasteful. The system shouldn't work.

But the museum stands. The catalog grows. The exhibits remain permanent.

And that's more interesting than whether it replaces your bank account.